Spread your money across multiple CDs to customize access to your funds.

By spreading your money across several CDs, you can tailor your savings to match your goals and ensure guaranteed returns.

What is CD laddering?

CD laddering is a savings strategy designed to yield high returns and give you frequent access to your earnings. By depositing your money in multiple CDs with different maturity dates, you can take advantage of higher APYs (annual percentage yield)4, while still ensuring a portion of your money is available for withdrawal at regular intervals.

How to build a CD ladder

-

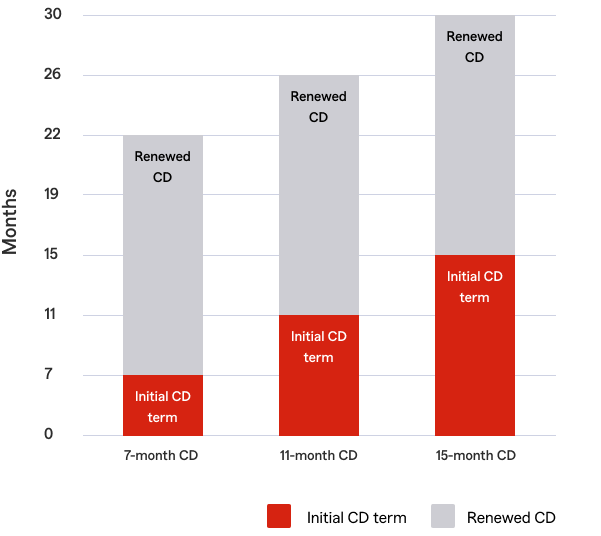

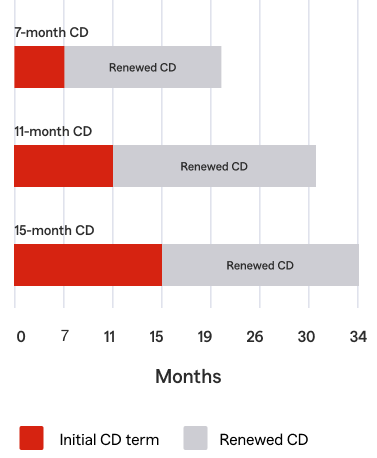

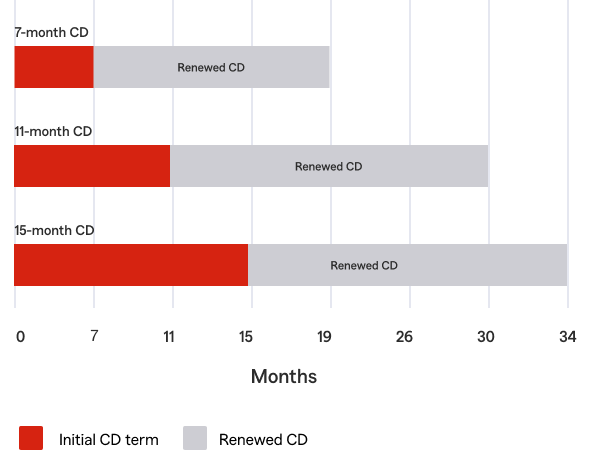

Open your CDs at the same time with varying term lengths.1, 2, 3 For example, a 15-month CD ladder would include 7-, 11-, and 15-month CDs.

-

When your first CD matures, you have the option to automatically roll the funds into the next CD2 in the ladder or make a withdrawal. If you choose the automatic rollover, the funds will be subject to the terms of that respective CD.

-

With three CDs maturing at different times, you get access to a portion of your funds overtime. Or, choose to keep saving and earn even more.

-

The image above shows an example CD ladder consisting of 7-, 11-, and 15-month CDs where each CD is renewed to continue the CD ladder to maintain the same access to funds

-

The image above shows an example CD ladder consisting of 7-, 11-, and 15-month CDs where each CD is renewed to continue the CD ladder to maintain the same access to funds

Build your CD ladder.

Find out how much you can earn. The APY4 is based off of U.S. Bank’s CD Special and is effective mm/dd/yy .

Fill in the information, to the left, and click "Build your CD ladder."

Three great reasons to open a CD ladder

-

Control over your savings

CD laddering spreads your money over multiple CDs with varying terms, providing more control over when you have access to portions of your money.

-

More for your money

CD laddering allows you to take advantage of higher APY rates by placing your money where it yields the most value.4

-

Guaranteed returns

CDs are not affected by the stock market, meaning once your CD ladder is funded, your returns are guaranteed.2

Three great reasons to open a CD ladder

-

Control over your savings

CD laddering spreads your money over multiple CDs with varying terms, providing more control on when you have access to your money.

-

More for your money

CD laddering allows you to take advantage of higher APY rates and placing your money where it yields the most value.4

-

Guaranteed returns

CDs are not affected by the stock market, meaning once your CD ladder is funded, your returns are guaranteed2

Frequently asked questions

-

Return to content, Footnote 1

$1,000 minimum opening deposit for a single CD with a maximum of $250,000. $2,000 minimum opening deposit for a CD ladder comprised of at least 2 CDs up to a maximum of $1,250,000 for up to 5 CDs.

-

Return to content, Footnote 2

Offer good for the initial term only. CD is automatically renewed for the same term. The rate is determined based on the published rate for the CD, excluding CD Specials, that is closest to but not exceeding the term of the CD. Advertised rate and APY are offered at the bank's discretion and may change daily.

-

Return to content, Footnote 3

FDIC insured to the maximum allowed by law.

-

Return to content, Footnote 4

Annual Percentage Yield (APY) assumes principal and interest remain on deposit for the term of the certificate. All interest payments for the APY will be made at the end of the term or annually, whichever occurs first. Interest is compounded daily. Penalty will be imposed for early withdrawal. Fees could reduce earning on the account.

-

Return to content, Footnote 5

Online application is not valid for single maturity CDs, business or retirement CDs, brokerage deposits, institutional investors, public funds or in conjunction with other promotional offers.

Deposit products are offered by U.S. Bank National Association. Member FDIC.

State Farm and the State Farm logo are registered trademarks of State Farm Mutual Automobile Insurance Company.